Cyber Insurance for Startups matters now more than ever. Startups rely on digital tools, cloud platforms, and customer data. These digital assets attract cyber-attacks. According to the Verizon Data Breach Investigations Report 2024, 43 percent of cyber-attacks target small businesses. This includes many startups. Startups often lack strong security controls and face urgent demands to grow fast. These factors increase their cyber risk and explain why cyber insurance has become essential. This guide explains how startups use cyber insurance for protection, what it covers, how to choose a policy, and the best providers for early stage companies.

What Is Cyber Insurance for Startups

Cyber insurance for startups is a policy that helps pay for costs when a cyber incident occurs. These incidents include data breaches, ransomware, business interruption, and legal costs. The policy helps with response actions, recovery work, and financial losses caused by attacks.

For startups, cyber insurance is both a safety net and a risk management tool. It connects important financial support with professional response resources. Startups with limited cash reserves can face major losses after an attack. Cyber insurance reduces this financial burden. It also helps startups build trust with partners, customers, and investors.

Why Startups Are Easy Targets

Startups face higher cyber risk for clear reasons. These factors also show why insurance makes sense.

• Limited security budget

• Remote teams

• Cloud systems

• Fast growth

Startups often operate with lean budgets. Security tools may be limited or delayed. Remote teams add complexity because personal devices and home networks are used. Cloud systems store important data but require proper controls. Rapid growth often means systems change fast and security planning lags behind. These issues explain why attackers focus on startups and why cyber insurance is a practical protection.

What Does Cyber Insurance Cover

Cyber insurance for startups includes specific protections. These coverages support recovery and reduce financial loss.

• Data breach response

• Legal costs

• Regulatory fines

• Business interruption

• Ransomware

Data breach response covers steps like investigation, system clean up, and notifying affected individuals. Legal costs help pay for lawyers and defines when lawsuits follow a breach. Regulatory fines can be expensive if laws like data protection rules apply. Business interruption reimbursement helps cover lost income when systems are down. Ransomware coverage pays for recovery costs, and sometimes extortion payments when justified.

Some policies also include support for social engineering losses, crisis communication, and public relations. Startups should check each coverage item carefully before buying a policy.

How Startups Use Cyber Insurance for Protection

Startups use cyber insurance in several practical ways. This extends beyond claim payments.

First, startups use cyber insurance to access professional response experts. After a breach, founders often face stress and uncertainty. The insurer’s incident response team guides actions for the first hours and days. This support reduces mistakes and speeds recovery.

Second, startups use cyber insurance to build confidence with investors. Many investors now ask about risk planning. Having a cyber insurance policy signals that the startup understands digital risk and plans ahead.

Third, cyber insurance helps protect customer trust. When customers see that a startup acts quickly and professionally after a breach, they remain loyal. This trust protects revenue and reputation.

Last, startups use cyber insurance to support compliance. Many industries now require data protection practices. Insurance helps cover regulatory costs and shows that founders take compliance seriously.

How to Choose the Right Policy

Choosing a policy requires careful comparison. Price alone is not enough.

• Check data limits

• Check ransomware coverage

• Check incident response support

Data limits should reflect the amount and type of data your startup handles. A retail startup with customer payment data needs higher limits than a small service provider. Ransomware coverage should include both payment and recovery costs. Some policies limit how much they pay for ransomware. Incident response support should be available 24 by 7, not just business hours.

Startups should also review exclusions. Some policies do not cover incidents involving third party cloud services unless specified. Ask the insurer about add ons that cover social engineering fraud and media liability. These extra coverages can prevent gaps that attackers exploit.

Coverage Comparison Table

| Coverage Area | Basic Policy | Advanced Policy |

| Data breach response | yes | yes |

| Ransomware payment | Limited | Full |

| Business interruption | Partial | Full |

| Regulatory fines | No | Yes |

| Incident response team | Limited hours | 24 by 7 support |

This table shows why startups should consider advanced coverage. Basic policies may be less costly but leave serious gaps.

Best Cyber Insurance Providers for Startups

Choosing the right provider matters. Some insurers specialize in startup risks and offer tailored support.

Mialtus insurance

Mialtus insurance offers startup friendly cyber insurance plans. Their coverage focuses on key startup risks. They provide strong incident response resources and help with claim navigation. Their policies match how startups use cyber insurance for protection.

JB Boda

JB Boda is one of India’s oldest insurance brokers. They offer customized cyber insurance solutions for startups and SMEs. Their strength lies in risk assessment support and policy structuring.

Turtlemint

Turtlemint focuses on digital insurance distribution. Their cyber insurance options are simple to compare and easy to buy. This works well for early stage startups looking for quick and affordable cyber insurance coverage without complex paperwork.

Square Insurance Brokers

Square Insurance offers startup friendly cyber insurance guidance. They focus on explaining policy terms in simple language. Their advisory model helps founders choose coverage based on real operational risk instead of marketing promises.

Ideal Insurance Brokers

Ideal Insurance Brokers provide cyber insurance solutions tailored for Indian SMEs and startups. They help startups compare multiple insurers and negotiate better coverage limits. Their experience with Indian compliance standards adds practical value.

Startups should compare quotes from these providers. Look at policy wording and incident support services, not only premiums.

Industry Risk and Cyber Threats

Some industries face higher cyber risk. For example, manufacturing startups dealing with connected systems and supply networks face frequent attacks. You can learn more about sector specific threats in the blog link Why Cyber Attacks Are Rising on SMEs in Manufacturing Industry

Healthcare tech startups handle sensitive patient data and face strict regulatory fines after breaches. Retail and ecommerce startups process payments and store customer information online. Fintech startups deal with financial data and face targeted attacks. Understanding industry risk helps startups choose the right cyber insurance coverage and limits.

Real Cost of Not Having Cyber Insurance

The cost of a cyber-attack extends beyond immediate damage. Startups face investigation costs, system rebuilds, legal fees, and customer notification costs. Downtime affects revenue directly. According to the IBM Cost of a Data Breach Report 2024, the average breach cost exceeded 3 million dollars globally. This data shows how expensive breaches can be and why cyber insurance matters for startups with limited cash reserves.

How Cyber Insurance Supports Growth

Cyber insurance supports growth in clear ways. It helps when startups seek partnerships. Many enterprises now ask startups to prove they have cyber insurance before signing integration contracts. It supports compliance with data privacy laws by covering fines and legal costs. Insurance also helps startups scale by aligning coverage with data volume. When startups plan exit events or funding rounds, having cyber insurance increases confidence for buyers and investors.

Common Mistakes Startups Make

- Choosing only low premium plans.

- Ignoring ransomware sub limits.

- Skipping incident response coverage.

- Not updating coverage after funding rounds.

These mistakes create exposure. Startups must update coverage as they grow. A static policy from founding stage may not cover new risks after product launches or customer growth.

Action Checklist for Founders

- Assess your data exposure.

- Map your revenue dependency on digital systems.

- Review past incidents in your industry.

- Compare Cyber Insurance for Startups providers.

- Read coverage details carefully.

- Ask about response time and support.

- Update policy after funding events.

Final Thoughts

Cyber insurance for startups is not about fear. It is about smart planning. Cyber risk will continue to grow as attackers automate attacks and exploit remote work trends. Startups will remain targets because they hold valuable data and often operate with limited security defenses.

Using cyber insurance for protection lets founders focus on growth while protecting cash flow and reputation. It supports investors, partners, and customers. Startups that adopt cyber insurance early build stronger foundations and reduce financial risk. Cyber insurance becomes part of a resilient business strategy in a digital world.

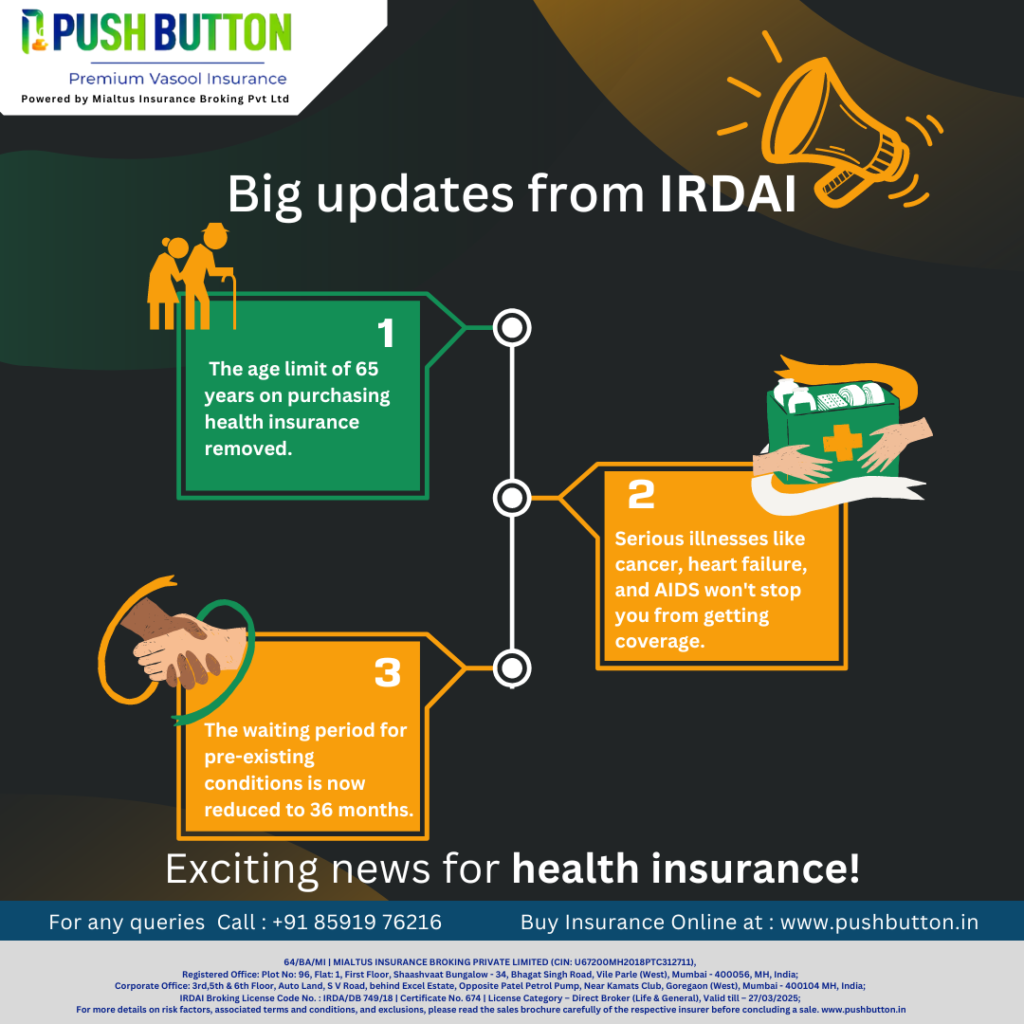

As of October 1, 2024, health insurance policies have become more favourable for customers.

Here are the key updates in health insurance regulations, making it easier to explain to potential buyers.

Key Updates in Health Insurance Policies:

-

Shorter Waiting Period for Pre-Existing Conditions

The waiting period for pre-existing conditions has been reduced from 48 months to 36 months. After this period, insurance companies cannot reject claims for pre-existing conditions, even if the policyholder didn’t disclose the condition earlier.

-

No Age Limit for Senior Citizens

Before, people over 65 couldn’t buy new health insurance. Now, there’s no age limit, so anyone—regardless of their age—can purchase a health policy.

-

Inclusive Health Coverage

Insurance companies must now offer health insurance to mental health patients, special needs children, transgenders, and people with HIV/AIDS. This makes health insurance more inclusive.

-

No Claim Denials After 5 Years

Insurance companies cannot deny claims after 5 years, even for reasons like non-disclosure or misrepresentation. However, if there’s proven fraud, the claim can still be contested in court.

-

Meaningful Discounts for No Claims

If no claims are made during the year, policyholders can choose between increasing the sum insured or getting a discount on their premium for the next year.

-

Refund Anytime

Policyholders can cancel their policy anytime and get a refund based on how long they used the policy. For example, if you pay Rs. 12,000 in premium and cancel after six months, you’ll get Rs. 6,000 back.

-

Higher Claim Settlement Chances

IRDAI has asked insurance companies to set up a committee called Claims Review Committee (CRC). This committee will review the claims, which are rejected by the insurer.

Further, claim requests can only be rejected after approval of this committee. Also, insurers will have to give reason for rejection along concerning the specific terms and conditions of the policy document.

-

Smoother Claim Settlement Process

Insurance companies and Third-Party Administrators (TPAs) must collect required documents directly from the hospital, so policyholders don’t have to submit them separately. Also, cashless claims should be processed within 1 hour, and final payments made within 3 hours of discharge.

At Mialtus Insurance Broking Pvt Ltd, we understand the challenges of maintaining good health and the importance of having comprehensive coverage. Contact us for the best health insurance policies and claim services. Our health insurance policies are designed to give you peace of mind, ensuring you and your family are protected during times of illness or medical emergencies. Call us on 8657528106 or visit our website to learn more about our customer-friendly health insurance plans.

As a small business owner or startup entrepreneur, you pour your heart and soul into building your dreams. But what if disaster strikes and your hard work goes up in flames? That’s where fire insurance comes in – offering a crucial safety net to protect your business from the unexpected.

Understanding Fire Insurance: A Lifeline for Small Businesses

Fire insurance is more than just a piece of paper – it’s your lifeline in times of crisis. It provides financial protection against the devastating effects of fire damage to your business premises, inventory, equipment, and more. For small businesses and startups, where every penny counts, having the right fire insurance policy can mean the difference between survival and closure.

Why Small Businesses Need Fire Insurance

Imagine this scenario: Your cozy café, bustling with customers and filled with the aroma of freshly brewed coffee, suddenly engulfed in flames. Without fire insurance, the cost of rebuilding your business from scratch could spell bankruptcy. But with the right policy in place, you can bounce back quickly, minimizing financial losses and keeping your dreams alive.

Key Benefits of Fire Insurance for Small Businesses

- Financial Protection: Fire insurance covers the cost of repairing or rebuilding your business premises, replacing damaged inventory and equipment, and even compensating for lost income during the downtime.

- Peace of Mind: With fire insurance, you can rest easy knowing that your business is protected against the unpredictable nature of fire accidents.

- Business Continuity: In the event of a fire, having insurance coverage means you can get back on your feet faster, minimizing disruption to your operations and retaining customer trust.

Choosing the Right Fire Insurance Policy

When it comes to fire insurance, one size doesn’t fit all. As a small business owner or startup, it’s crucial to choose a policy that aligns with your unique needs and budget. Here are some key factors to consider:

- Coverage Limits: Make sure your policy provides adequate coverage for your business assets, including buildings, inventory, equipment, and any other valuable assets.

- Exclusions: Pay attention to any exclusions or limitations in the policy, such as coverage for certain types of property or specific causes of fire.

- Claims Process: Look for an insurance provider with a streamlined claims process and a reputation for reliability and promptness in handling claims.

- Cost vs. Value: While affordability is important, don’t skimp on coverage just to save a few bucks. Invest in comprehensive coverage that offers maximum value for your money.

Conclusion:

Protect Your Business, Protect Your Dreams

In the unpredictable world of small business ownership, fire insurance is your best defence against the unforeseen. Don’t wait until disaster strikes – take proactive steps to safeguard your business and preserve your dreams for the future. With the right fire insurance policy in place, you can focus on what you do best – building and growing your business – with the peace of mind that comes from knowing you’re protected.

Remember, your business is more than just a source of income – it’s a reflection of your passion, dedication, and entrepreneurial spirit. Protect it, nurture it, and watch it thrive with the security of fire insurance by your side.

For personalized guidance and assistance in choosing the right fire insurance policy for your small business or startup, reach out to our team of experts today. We’re here to help you protect your dreams and build a brighter future, one flame at a time.