The Super Star Health Insurance Plan is a well-rounded, adaptable health insurance policy designed to meet the evolving needs of individuals and families. Star Health and Allied Insurance Co. Ltd., India’s pioneering standalone health insurer, offers this plan with a range of features and add-ons, ensuring comprehensive protection for all stages of life. Here’s a breakdown of the plan’s key offerings and why it could be the ideal choice for those seeking robust health coverage.

Key Features of the Super Star Plan

- Automatic Restoration of Sum Insured

- This feature ensures that the sum insured is automatically reinstated up to 100% after it is used, with no limit on the number of restorations. This makes the plan especially valuable for families or individuals with multiple claims in a policy year.

- Age Freeze Benefit

- With the “Freeze Your Age” feature, policyholders lock in their age at the time of purchasing the policy. This age-based premium remains constant until a claim is made, enabling long-term savings on premiums as the insured ages.

- Room Flexibility and Extensive Hospital Network

- The plan offers unrestricted access to any room type in network hospitals across India, allowing policyholders to choose a room that best suits their needs without incurring additional costs.

In-Built Benefits

- Cumulative Bonus: For each claim-free year, the plan provides a cumulative bonus amounting to 50% of the sum insured, up to a maximum of 100%.

- Home Care and Domiciliary Hospitalization: Provides coverage for home-based treatment for specific conditions when hospital care is not possible, a helpful benefit for patients with limited mobility or in remote areas.

- Dental Coverage: Dental consultations, X-rays, and cleanings are covered from the second policy year onward, adding extra value for families.

Comprehensive Hospitalization Coverage

The Super Star plan covers a wide array of hospitalization-related expenses, including:

- In-Patient Treatments: Coverage includes all hospital-related expenses like room rent, ICU charges, doctor’s fees, surgical appliances, and advanced medical treatments.

- Day Care Procedures: All day care procedures that do not require overnight hospitalization are covered, providing added flexibility for minor but necessary treatments.

- Organ Donor Expenses: Costs related to organ donation, including complications post-donation, are covered under this plan.

- Modern Treatments: Advanced medical treatments such as oral chemotherapy, robotic surgeries, and stem cell therapy for bone marrow transplants are also included, demonstrating the plan’s alignment with modern healthcare needs.

Additional Benefits

- Tele-Consultations and AI-Driven Health Monitoring: Policyholders can access unlimited tele-consultations through the Star Health app. The plan also offers an AI-driven face scan to monitor vital parameters like heart rate and oxygen saturation twice a month.

- Air and Road Ambulance Coverage: For emergencies, air ambulance reimbursement up to ₹5,00,000 per year and road ambulance expenses are covered, ensuring prompt transportation in critical situations.

Wellness and Rewards Program

The STAR Wellness Program allows policyholders to earn wellness points through various health and wellness activities via the Star Health app. These points can be redeemed for up to a 20% discount on renewal premiums, promoting a proactive approach to health.

Optional Add-Ons

The Super Star plan offers numerous add-ons to customize coverage based on specific needs, including:

- Newborn and Delivery Cover: Covers delivery expenses and newborn medical needs from day one, with options to enhance limits.

- Accidental Death and Disability Coverage: Options for accidental death and disability benefits with worldwide geographical scope.

- Reduced Waiting Period for Pre-Existing Diseases (PED): This optional cover reduces the PED waiting period to as low as 12 months for conditions like diabetes and hypertension.

- Daily Cash Benefit: Offers a daily hospital cash benefit of ₹1,000 to ₹5,000, with options for up to 180 days of hospitalization.

Discounts and Incentives

The Super Star plan offers attractive discounts, including:

- Long-Term Policy Discounts: Discounts on premiums for policy terms of 2 to 5 years, with savings of up to 16%.

- Lifestyle Discounts: Up to 10% off based on lifestyle-related health questionnaires.

- Early Renewal Discounts: Policyholders renewing 30 days before the due date are eligible for early renewal discounts.

Diwali, the festival of lights, is a time of joy, celebration, and new beginnings. It’s time when we clean and decorate our homes, light diyas, share sweets, and celebrate with family and friends. But Diwali also brings additional expenses, from festive shopping to gifting and even home improvements. So, while we celebrate, it’s also wise to take steps to secure our finances and make the most of our money.

Here are the top 5 financial tips to help you enjoy a prosperous and secure Diwali this year!

1. Set a Budget for Festive Spending

Diwali expenses can easily add up – whether it’s buying gifts, new clothes, or decorations. Before you start shopping, take some time to set a budget. Allocate specific amounts for each category like clothes, gifts, sweets, and household items. Setting a budget will help you avoid overspending and make sure you don’t dip into your savings or emergency funds.

Tip: Use digital budgeting apps like Walnut, Money Manager, or Google Sheets to track your spending throughout the festive season. Staying within your budget will help you save more and keep your finances stable.

2. Avoid Unnecessary Debt

Festivals often tempt us into spending more, and some people even consider taking loans or using credit cards for expenses. However, it’s important to remember that debt can lead to financial stress later. If you must use a credit card, be mindful of your expenses and ensure you can pay the balance on time. Avoid making high-interest purchases on credit, like jewelry or luxury items, which may lead to a debt trap if not managed carefully.

Pro Tip: Consider an interest-free EMI option if you need to make big purchases. Many banks and digital payment apps like Paytm, Amazon Pay, and Flipkart offer these schemes during the festive season.

3. Secure Your Health and Home with Insurance

Diwali is a time for celebrations, but accidents and mishaps can happen, especially with fireworks and diyas around. Protect your family and assets by investing in the right insurance policies. A health insurance policy ensures that you have financial support in case of medical emergencies, while home insurance protects your property from fire, theft, and other damages.

With various insurance options available, you can choose plans that suit your needs and give you peace of mind. This Diwali, prioritize your family’s safety and security by investing in insurance.

Quick Suggestion: Look for comprehensive health insurance that covers hospital expenses, and a fire insurance policy to protect your home.

4. Take Advantage of Festive Investment Offers

Many banks and financial institutions offer special investment schemes during Diwali. From fixed deposits with higher interest rates to discounts on mutual funds and other financial products, these offers can be a good way to grow your savings.

If you’re planning long-term investments, consider options like Systematic Investment Plans (SIPs) in mutual funds or Public Provident Fund (PPF) for tax benefits. Investing during Diwali, often considered an auspicious time, can give you a great start towards building wealth for the future.

Pro Tip: Check out short-term investment options like liquid funds if you’re looking for returns with lower risks and easy liquidity.

5. Plan for the Future with Tax-Saving Investments

As the financial year is coming to an end in March, now is a good time to start planning your tax-saving investments. Consider options like ELSS (Equity-Linked Savings Scheme) mutual funds, PPF, or National Pension System (NPS) to reduce your taxable income while securing your financial future.

Tax-saving investments not only help you save on taxes but also grow your wealth over time. Setting up these investments around Diwali gives you a few months to meet your financial goals by the end of the fiscal year.

Quick Suggestion: Start a SIP in an ELSS mutual fund for tax benefits and potential long-term growth. ELSS investments have a three-year lock-in period and can offer better returns compared to other tax-saving options.

Final Thoughts

Diwali is the perfect time to reflect on your financial habits and make a fresh start. These five financial tips – setting a budget, avoiding unnecessary debt, securing your health and home, making smart investments, and planning for tax savings – can help you make the most of your money and ensure financial stability.

By taking small steps today, you can celebrate a worry-free and financially secure Diwali. After all, true prosperity comes not just from spending, but also from saving and investing wisely. Here’s wishing you a Diwali filled with joy, prosperity, and financial security!

Dussehra is a time of victory, celebration, and new beginnings. It marks the triumph of good over evil, making it the perfect occasion to start fresh and adopt positive habits. This Dussehra, why not make some healthy resolutions that will not only benefit you but also those around you?

Here are the top health and wellness resolutions you should consider to make this festive season more meaningful and secure your future.

-

Prioritize Your Mental Health

With the fast-paced lifestyle many of us lead, mental health often takes a back seat. This Dussehra, resolve to make mental wellness a priority. Whether it’s through meditation, mindfulness, or simply taking breaks when needed, find ways to relieve stress and maintain mental peace.

- Tip: Try starting your day with 10 minutes of meditation or breathing exercises to stay calm and focused.

-

Adopt a Balanced Diet

Festivals are known for indulgent food, but a balanced diet is key to long-term health. This Dussehra, aim to make smarter food choices, even while enjoying festive treats. Incorporate more fruits, vegetables, and whole grains into your meals to maintain energy and health.

- Tip: Follow the 80/20 rule: 80% of your food should be wholesome, while 20% can be indulgent festive favourites.

-

Commit to Regular Exercise

Physical fitness is essential for a long and healthy life. This Dussehra, resolve to stay active! Whether it’s yoga, walking, gym workouts, or even Garba, find activities that you enjoy and make them part of your routine. Regular exercise improves your physical and mental well-being.

- Tip: Start small! Commit to 30 minutes of physical activity each day—consistency is more important than intensity.

-

Secure Your Future with Health Insurance

Your health is your greatest asset, and securing it should be a top priority. This Dussehra, make a resolution to invest in comprehensive health insurance for you and your family. Insurance protects you against unexpected medical expenses and provides peace of mind in the event of a health emergency.

- Tip: Evaluate your insurance options and choose a plan that suits your specific needs. Consider policies that offer both preventive care and critical illness coverage.

-

Practice Digital Detox

In a world dominated by screens, it’s easy to get overwhelmed with information and distractions. Resolve to take time away from digital devices, especially social media, to refresh your mind and improve focus. Use this Dussehra to set healthy boundaries with technology.

- Tip: Set a specific time each day to unplug from all screens and spend time in nature or with loved ones.

-

Get Enough Sleep

Good sleep is crucial for overall health, yet many of us neglect it. This Dussehra, commit to getting 7-8 hours of restful sleep each night. Adequate sleep improves mood, memory, and immune function, helping you stay productive and happy.

- Tip: Create a sleep routine—avoid screens before bed, keep your room dark and cool, and go to sleep at the same time every night.

-

Stay Hydrated

It may seem simple, but staying hydrated is one of the easiest and most effective ways to maintain good health. Drinking enough water improves digestion, keeps your skin healthy, and helps you stay energetic throughout the day.

- Tip: Set reminders on your phone to drink water throughout the day, especially during the festive season when you’re more likely to get dehydrated.

-

Focus on Preventive Health Checkups

Prevention is better than cure! This Dussehra, make a resolution to schedule regular health checkups for early detection of any potential health issues. These checkups can save lives by catching conditions early when they’re easier to treat.

- Tip: Many health insurance plans now offer preventive health checkups as part of their benefits—take advantage of these features.

-

Be Kind to Yourself and Others

The festival season is about kindness, empathy, and positivity. This Dussehra, resolve to be kinder to yourself and to others. Practising kindness boosts emotional health and creates a ripple effect of positivity in your environment.

- Tip: Set daily reminders to appreciate yourself and your accomplishments, and make it a habit to offer words of encouragement to those around you.

This festive season, protect what matters most—your health and your future! Talk to our experts today to find the perfect health insurance plan tailored to your needs.

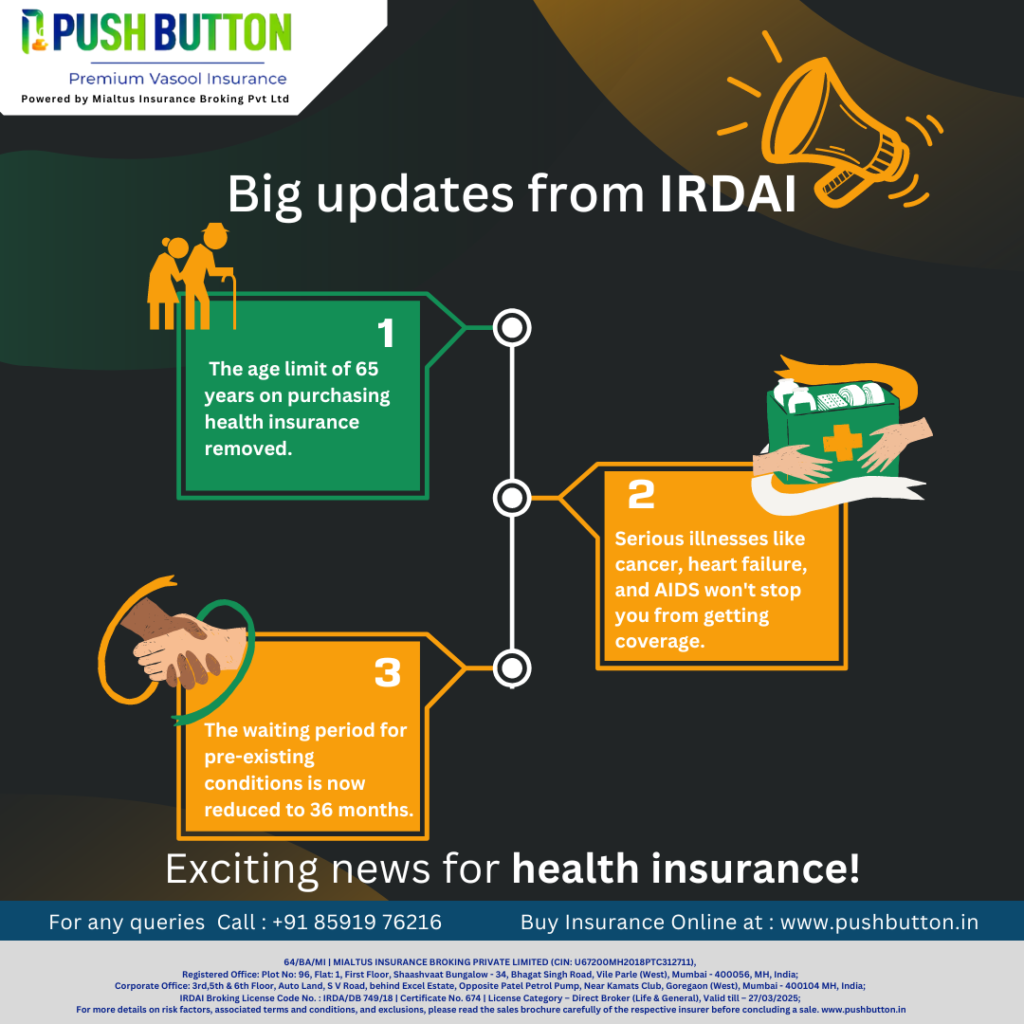

As of October 1, 2024, health insurance policies have become more favourable for customers.

Here are the key updates in health insurance regulations, making it easier to explain to potential buyers.

Key Updates in Health Insurance Policies:

-

Shorter Waiting Period for Pre-Existing Conditions

The waiting period for pre-existing conditions has been reduced from 48 months to 36 months. After this period, insurance companies cannot reject claims for pre-existing conditions, even if the policyholder didn’t disclose the condition earlier.

-

No Age Limit for Senior Citizens

Before, people over 65 couldn’t buy new health insurance. Now, there’s no age limit, so anyone—regardless of their age—can purchase a health policy.

-

Inclusive Health Coverage

Insurance companies must now offer health insurance to mental health patients, special needs children, transgenders, and people with HIV/AIDS. This makes health insurance more inclusive.

-

No Claim Denials After 5 Years

Insurance companies cannot deny claims after 5 years, even for reasons like non-disclosure or misrepresentation. However, if there’s proven fraud, the claim can still be contested in court.

-

Meaningful Discounts for No Claims

If no claims are made during the year, policyholders can choose between increasing the sum insured or getting a discount on their premium for the next year.

-

Refund Anytime

Policyholders can cancel their policy anytime and get a refund based on how long they used the policy. For example, if you pay Rs. 12,000 in premium and cancel after six months, you’ll get Rs. 6,000 back.

-

Higher Claim Settlement Chances

IRDAI has asked insurance companies to set up a committee called Claims Review Committee (CRC). This committee will review the claims, which are rejected by the insurer.

Further, claim requests can only be rejected after approval of this committee. Also, insurers will have to give reason for rejection along concerning the specific terms and conditions of the policy document.

-

Smoother Claim Settlement Process

Insurance companies and Third-Party Administrators (TPAs) must collect required documents directly from the hospital, so policyholders don’t have to submit them separately. Also, cashless claims should be processed within 1 hour, and final payments made within 3 hours of discharge.

At Mialtus Insurance Broking Pvt Ltd, we understand the challenges of maintaining good health and the importance of having comprehensive coverage. Contact us for the best health insurance policies and claim services. Our health insurance policies are designed to give you peace of mind, ensuring you and your family are protected during times of illness or medical emergencies. Call us on 8657528106 or visit our website to learn more about our customer-friendly health insurance plans.

In a landmark decision aimed at enhancing the well-being of the elderly, the Union government has approved a free health insurance cover of ₹5 lakh for all citizens aged 70 and above. This monumental move is part of the government’s flagship Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PMJAY), ensuring that India’s senior citizens receive much-needed healthcare coverage at no cost.

This initiative is set to benefit 6 crore senior citizens across 4.5 crore families, providing crucial healthcare support to the elderly population, many of whom face rising medical expenses. The free health cover, worth ₹5 lakh per year, will be on a family basis and is aimed at ensuring that senior citizens have access to essential healthcare services without the financial burden.

A Lifeline for Senior Citizens

The approved health coverage will operate on a top-up basis. For families already covered under the Ayushman Bharat Scheme, the senior citizens above 70 years will receive an additional cover of ₹5 lakh, specifically reserved for their use. This coverage is exclusive to the individual above 70 and does not need to be shared with other family members who are younger.

This initiative is open to all senior citizens, irrespective of their socio-economic status, making it a truly inclusive scheme. Additionally, senior citizens who are already receiving benefits from other public health insurance schemes can choose to either continue with their current plan or opt into Ayushman Bharat PMJAY for this top-up benefit.

A Promise Fulfilled

This announcement comes as a fulfillment of Prime Minister Narendra Modi’s promise made during the run-up to the general elections. The PM had committed to improving the health infrastructure and making healthcare more accessible for all, particularly the vulnerable elderly population.

The decision underscores the government’s focus on providing healthcare security to senior citizens, who often face age-related health challenges and are more susceptible to chronic illnesses. By introducing this free health insurance cover, the government aims to alleviate financial stress on families and offer peace of mind to the elderly, knowing they can access medical care without worrying about high costs.

A Step Toward Universal Healthcare

The Ayushman Bharat PMJAY scheme has already been lauded as one of the world’s largest public health insurance initiatives. With this latest addition, the scheme continues to set benchmarks in providing healthcare access to the most vulnerable sections of society. The new health coverage for senior citizens further strengthens the government’s vision of “Health for All”, ensuring that no one is left behind, regardless of age or financial background.

What Does This Mean for You?

Families with senior citizens above the age of 70 can now rest assured that their loved ones are protected under the Ayushman Bharat scheme, with no additional cost. The scheme offers:

- Free health insurance coverage of ₹5 lakh per year, reserved exclusively for individuals above 70 years of age.

- Top-up cover for families already enrolled in the Ayushman Bharat scheme, ensuring more comprehensive healthcare for the elderly.

- Access to public and private healthcare facilities across the country, ensuring that senior citizens can receive timely and quality medical treatment.

Conclusion

The Union government’s decision to extend free health coverage to all senior citizens above 70 years is a significant step toward ensuring that India’s elderly population is well cared for. With this initiative, millions of families across the country will have the support they need to navigate healthcare challenges with ease, ensuring that senior citizens can live their golden years with dignity and security.

For more information on how to avail of this scheme or explore other health insurance options, feel free to reach out to us. Let’s work together to secure the health of your loved ones!

Our much-anticipated 6th Annual Awards Event, Drishti, was a resounding success, bringing together industry leaders, employees, and stakeholders for an unforgettable experience. Held to celebrate our growth and acknowledge the efforts that drive our achievements, Drishti has become a key milestone in our journey as an insurance broking firm.

A Day of Inspiration and Recognition

From the very start, Drishti was packed with insightful sessions and engaging discussions. We recognized outstanding contributions from our team members and celebrated the progress we’ve made over the past year. The energy and passion displayed by every attendee highlighted the strength of our firm and the importance of teamwork.

Event Highlights:

- Keynote Address: Our leadership shared inspiring messages on the future of the insurance broking industry, touching on innovation, client trust, and growth.

- Awards Ceremony: We honoured employees across various departments who demonstrated excellence and dedication to client satisfaction.

- Engaging Sessions: Thought leaders in the insurance field presented the latest trends and challenges in the industry, providing actionable insights.

Capturing the Moments:

Be sure to check out the event highlights in the gallery below, featuring some of the best moments from Drishti. Image 7 showcases our leadership team on stage, sharing their vision for the future, while Image 8 captures the celebration of award winners.

We are proud of what we’ve accomplished, and Drishti served as a reminder that, together, we can overcome challenges and set even higher standards in the industry. As we look forward to another year, we remain committed to providing exceptional insurance broking services to our clients.

Stay tuned for more updates, and don’t forget to celebrate with us by exploring the images from this unforgettable event!

The monsoon season brings much-needed relief from the scorching summer heat, but it also presents a unique set of challenges for car owners. Heavy rains, waterlogged roads, and reduced visibility can take a toll on your vehicle, making proper maintenance crucial during this time. This comprehensive guide will help you navigate monsoon car care, ensuring your vehicle stays in optimal condition and keeps you safe on the road.

-

Check Your Tyres

Your tyres are the only contact between your car and the road, making their condition vital, especially during the monsoon. Here’s what to do:

- Tread Depth: Ensure your tyres have adequate tread depth (at least 2-3 mm) to provide sufficient grip on wet roads.

- Tyre Pressure: Maintain the correct tyre pressure as per the manufacturer’s recommendation. Both under-inflated and over-inflated tyres can lead to reduced traction.

- Alignment and Balancing: Get your tyres aligned and balanced to prevent uneven wear and improve handling on slippery roads.

-

Inspect Your Brakes

Brakes are critical for safe driving in any weather, but even more so during the monsoon.

- Brake Pads and Discs: Regularly inspect your brake pads and discs for wear and tear. Replace them if they show signs of excessive wear.

- Brake Fluid: Check the brake fluid level and top it up if necessary. Old or contaminated brake fluid can affect braking efficiency.

-

Ensure Proper Lighting

Good visibility is essential when driving in heavy rain and low-light conditions.

- Headlights and Taillights: Make sure your headlights and taillights are functioning correctly. Replace any burnt-out bulbs immediately.

- Fog Lights: If your car is equipped with fog lights, ensure they are working properly. They can significantly improve visibility during dense fog or heavy rain.

- Indicator and Brake Lights: Check that all indicator and brake lights are operational to signal your intentions to other drivers clearly.

-

Maintain Windshield Wipers

Clear vision is crucial for safe driving during the monsoon.

- Wiper Blades: Inspect your windshield wiper blades for any signs of wear or damage. Replace them if they leave streaks or make noise.

- Windshield Washer Fluid: Keep the windshield washer fluid reservoir filled with a suitable cleaning solution. It helps clear dirt and debris from the windshield.

-

Protect Your Car’s Exterior

The monsoon can be harsh on your car’s exterior.

- Waxing: Apply a coat of wax to your car’s exterior to protect the paint from water and mud. It also makes cleaning easier.

- Underbody Protection: Consider applying an anti-rust coating to your car’s underbody to prevent rust and corrosion caused by water and mud.

-

Check Your Car’s Electrical System

The electrical system is vulnerable to moisture during the monsoon.

- Battery: Ensure your car’s battery is in good condition. Check the terminals for corrosion and clean them if necessary.

- Electrical Components: Inspect all electrical components, including lights, indicators, and the horn, to ensure they are functioning properly.

-

Interior Care

Keep your car’s interior dry and mold-free.

- Floor Mats: Use rubber floor mats to prevent water from seeping into the carpet and causing mold.

- Air Conditioning: Use the air conditioning system to dehumidify the air inside the car and prevent the windows from fogging up.

Final Thoughts

Taking these precautions will help keep your car in top condition and ensure a safe driving experience during the monsoon. Regular maintenance and timely checks can go a long way in preventing breakdowns and accidents.

At Mialtus Insurance Broking Pvt Ltd, we understand the challenges of driving during the monsoon and the importance of keeping your car in perfect condition. Contact us for the best car insurance quotes and claim services. Our comprehensive car insurance policies are designed to provide you with the peace of mind you need during the rainy season. Call us today or visit our website to learn more.

Stay safe and drive carefully!

-

Boost Your Immune System

A strong immune system is your first line of defense against infections and illnesses. During the monsoon, it is crucial to:

- Eat a Balanced Diet: Include plenty of fruits, vegetables, and whole grains in your diet. Foods rich in Vitamin C, such as oranges, strawberries, and bell peppers, can enhance your immunity.

- Stay Hydrated: Drink plenty of water, herbal teas, and soups. Avoid street food and water from unreliable sources to prevent waterborne diseases.

- Exercise Regularly: Engage in indoor exercises like yoga, pilates, or home workouts to keep your body fit and active.

- Get Adequate Sleep: Ensure you get 7-8 hours of sleep each night to help your body repair and rejuvenate.

-

Maintain Personal Hygiene

Personal hygiene is paramount to prevent infections during the monsoon:

- Wash Your Hands: Frequently wash your hands with soap and water, especially before eating and after coming home from outside.

- Keep Your Feet Dry: Wet and muddy conditions can lead to fungal infections. Dry your feet thoroughly after coming in contact with water and wear waterproof footwear when stepping out.

- Use Antibacterial Products: Use antibacterial soaps, hand sanitizers, and body washes to reduce the risk of infections.

-

Protect Yourself from Mosquitoes

The monsoon season is breeding time for mosquitoes, increasing the risk of vector-borne diseases like dengue, malaria, and chikungunya:

- Use Mosquito Repellents: Apply mosquito repellent creams and sprays on exposed skin.

- Install Nets: Use mosquito nets on windows and doors and sleep under a mosquito net.

- Eliminate Stagnant Water: Ensure there is no stagnant water around your home, as it serves as a breeding ground for mosquitoes. Regularly empty and clean water containers, flower pots, and drains.

-

Watch Your Diet

Food contamination is common during the monsoon, leading to gastrointestinal issues:

- Eat Freshly Cooked Food: Avoid consuming food that has been left out for a long time. Eat freshly prepared meals to reduce the risk of foodborne illnesses.

- Wash Fruits and Vegetables Thoroughly: Clean all fruits and vegetables under running water to remove any contaminants.

- Avoid Street Food: Street food may be tempting, but it is best to avoid it during the monsoon due to hygiene concerns.

-

Stay Dry and Warm

Keeping yourself dry and warm is crucial to prevent colds and flu:

- Carry an Umbrella or Raincoat: Always have an umbrella or raincoat with you to stay dry during sudden showers.

- Wear Waterproof Footwear: Invest in a good pair of waterproof shoes or boots to keep your feet dry.

- Dry Wet Clothes Promptly: Do not stay in wet clothes for too long. Change into dry clothing as soon as possible to avoid fungal infections.

-

Take Care of Your Skin

The humidity and dampness during the monsoon can affect your skin:

- Keep Your Skin Clean and Dry: Wash your face regularly and use a gentle cleanser to keep your skin clean. Pat dry your skin after washing.

- Moisturize: Use a light, non-greasy moisturizer to keep your skin hydrated without making it oily.

- Exfoliate: Regularly exfoliate your skin to remove dead skin cells and prevent acne and other skin issues.

-

Be Cautious of Waterborne Diseases

Waterborne diseases are rampant during the monsoon:

- Drink Safe Water: Always drink boiled or filtered water. Avoid drinking water from unknown sources.

- Practice Good Sanitation: Ensure proper sanitation and hygiene to prevent diseases like typhoid, cholera, and hepatitis A.

-

Ensure Clean Surroundings

A clean environment can significantly reduce the risk of infections:

- Clean Your Home Regularly: Sweep and mop the floors daily to keep your home clean and dry.

- Dispose of Waste Properly: Ensure garbage is disposed of properly and not left out in the open.

- Ventilate Your Home: Keep windows open when it is not raining to allow fresh air to circulate and prevent dampness.

-

Stay Informed and Prepared

Being informed and prepared can help you take prompt action:

- Keep Emergency Contacts Handy: Have a list of emergency contacts, including doctors, hospitals, and your insurance provider.

- Stay Updated: Follow news and weather updates to be aware of any health advisories or potential hazards.

- Have a First Aid Kit: Keep a well-stocked first aid kit at home, including basic medicines, bandages, and antiseptics.

-

Get Regular Health Check-ups

Regular health check-ups can help detect any potential health issues early:

- Visit Your Doctor: Schedule regular visits to your healthcare provider for routine check-ups.

- Monitor Chronic Conditions: If you have chronic conditions like diabetes, hypertension, or asthma, ensure they are well-managed and under control.

Conclusion

The monsoon season brings with it both joy and challenges. By following these health tips, you can enjoy the rains while keeping yourself and your family protected from the common health issues associated with this season. As an insurance broking firm, we are committed to your well-being. Remember, preventive care is always better than cure. Stay safe, stay healthy, and make the most of the monsoon!

Let’s ensure you have a healthy and worry-free monsoon season!

As a small business owner or startup entrepreneur, you pour your heart and soul into building your dreams. But what if disaster strikes and your hard work goes up in flames? That’s where fire insurance comes in – offering a crucial safety net to protect your business from the unexpected.

Understanding Fire Insurance: A Lifeline for Small Businesses

Fire insurance is more than just a piece of paper – it’s your lifeline in times of crisis. It provides financial protection against the devastating effects of fire damage to your business premises, inventory, equipment, and more. For small businesses and startups, where every penny counts, having the right fire insurance policy can mean the difference between survival and closure.

Why Small Businesses Need Fire Insurance

Imagine this scenario: Your cozy café, bustling with customers and filled with the aroma of freshly brewed coffee, suddenly engulfed in flames. Without fire insurance, the cost of rebuilding your business from scratch could spell bankruptcy. But with the right policy in place, you can bounce back quickly, minimizing financial losses and keeping your dreams alive.

Key Benefits of Fire Insurance for Small Businesses

- Financial Protection: Fire insurance covers the cost of repairing or rebuilding your business premises, replacing damaged inventory and equipment, and even compensating for lost income during the downtime.

- Peace of Mind: With fire insurance, you can rest easy knowing that your business is protected against the unpredictable nature of fire accidents.

- Business Continuity: In the event of a fire, having insurance coverage means you can get back on your feet faster, minimizing disruption to your operations and retaining customer trust.

Choosing the Right Fire Insurance Policy

When it comes to fire insurance, one size doesn’t fit all. As a small business owner or startup, it’s crucial to choose a policy that aligns with your unique needs and budget. Here are some key factors to consider:

- Coverage Limits: Make sure your policy provides adequate coverage for your business assets, including buildings, inventory, equipment, and any other valuable assets.

- Exclusions: Pay attention to any exclusions or limitations in the policy, such as coverage for certain types of property or specific causes of fire.

- Claims Process: Look for an insurance provider with a streamlined claims process and a reputation for reliability and promptness in handling claims.

- Cost vs. Value: While affordability is important, don’t skimp on coverage just to save a few bucks. Invest in comprehensive coverage that offers maximum value for your money.

Conclusion:

Protect Your Business, Protect Your Dreams

In the unpredictable world of small business ownership, fire insurance is your best defence against the unforeseen. Don’t wait until disaster strikes – take proactive steps to safeguard your business and preserve your dreams for the future. With the right fire insurance policy in place, you can focus on what you do best – building and growing your business – with the peace of mind that comes from knowing you’re protected.

Remember, your business is more than just a source of income – it’s a reflection of your passion, dedication, and entrepreneurial spirit. Protect it, nurture it, and watch it thrive with the security of fire insurance by your side.

For personalized guidance and assistance in choosing the right fire insurance policy for your small business or startup, reach out to our team of experts today. We’re here to help you protect your dreams and build a brighter future, one flame at a time.