As the NRI homecoming season nears, many non-resident Indians (NRIs) must be revisiting their financial strategies, with life insurance emerging as a key consideration. The appeal of Indian life insurance policies is growing among NRIs, thanks to their competitive premiums, comprehensive coverage, and tax advantages.

How NRIs can buy life insurance in India

The process of purchasing life insurance in India has become more convenient for NRIs, with online platforms and flexible payment options simplifying the process. NRIs can now buy policies remotely, without having to be physically present in India.

Bajaj Allianz Life and Tata AIA Life Insurance have adapted their offerings to meet the needs of overseas customers, enabling online applications and payments via NRE (non-resident external) or NRO (non-resident ordinary) accounts.

Tata AIA Life Insurance, for example, has expanded its reach by launching life insurance products through Gujarat International FinTech (GIFT) City, India’s first international financial services centre (IFSC).

This allows NRIs to access dollar-denominated policies, helping them hedge against currency fluctuations. “NRIs can explore plans, select coverage, and customise policies from anywhere in the world,” the company noted.

Here’s a look at the process

- Policies can be purchased online, through authorised representatives, or via brokers specialising in NRI services.

- Premiums can be paid using non-resident external (NRE) or non-resident ordinary (NRO) accounts, foreign bank accounts, or even international credit cards.

- Most insurers provide digital processes for documentation and verification.

- Life Insurance companies simplify medical pre-requirements for NRIs by partnering with medical centres in over 40 countries.

Advantages of Indian life insurance policies for NRIs

Indian life insurance policies offer several benefits that make them an attractive choice for NRIs. For instance, maturity proceeds and death benefits are often tax-free under Indian tax laws, a feature that might not be available with foreign insurance policies.

Indian insurers also offer flexibility in premium payment options, allowing NRIs to pay premiums in foreign currencies through their NRE or NRO accounts.

“India continues to provide ample opportunities for robust financial planning and capital growth, through various tools including life insurance, for NRIs,” said Rajesh Krishnan, Chief Operations and Customer Experience Officer at Bajaj Allianz Life.

Krishnan added, “India offers attractive premium rates for protection plans compared to what NRIs might pay for similar policies in their country of residence. Moreover, these products — ranging from savings and wealth-building life insurance plans — offer unique features, competitive returns, and convenience.”

A look at features and facilities offered by Indian insurers

Indian life insurers provide a range of features and facilities designed to meet the unique needs of NRIs.

One of their key offerings is the ‘Life Protect Supreme’ plan, which offers comprehensive protection up to the age of 100 years.

“This plan covers death and critical illness until 100 years of age, and accidental and disability protection up to 85 years,” explained a Tata AIA spokesperson.

The policy also allows for no limits on the sum assured and a minimum sum assured of $50,000. Further, investing in an Indian rupee-denominated policy allows NRIs to shield themselves from foreign currency fluctuations.

Many NRIs prefer Indian policies for estate planning, as they can direct the proceeds to specific beneficiaries, ensuring that their estate is distributed as per their wishes.

“Indian policies provide tax benefits under the Indian Income Tax Act and GST laws, making them financially advantageous for NRIs,” said Nitin Mehta, Chief Distribution Officer and Head of Marketing at Bharti AXA Life Insurance. He further noted, “Indian life insurance policies help ensure the financial security of the policyholder’s family in India, providing peace of mind, especially in case of unexpected life events.”

Mehta added that NRIs can also benefit from flexible premium payment options and comprehensive coverage.

Sourcr: CNBC TV8

People buy general insurance to cover for emergencies so that they do not have to make out-of-pocket hefty payments. They do not just put their money in, but trust while paying premiums. However, not all claims get approved. A recent report reveals that the claim-to-settlement ratio, which shows how many claims were honoured by insurers, in 2022-23 at 86%, which is down from the 87% in FY22.

The detailed report by the Insurance Brokers Association of India (IBAI) from data presented by insurance companies reveals that claims repudiation ratio rose to 6% for general insurance, which includes coverage for motor, health, fire and marine cargo.

This is the claim rejected by an insurance company as a proportion of the total claims made by its policy buyers. Public sector insurer New India Assurance has the lowest claims repudiation ratio of 0.2%. Other big private insurers with lower rates of claims rejection are HDFC Ergo, Future Generali, Aditya Birla Health and Shriram.

Insurance watchdog IRDAI makes it mandatory for insurance companies to put out settlements and rejection data on their websites. The IBAI has collated the data from insurers and put it in a report, which could help people make informed choices about a company’s track record while buying insurance policies. In the Policyholder’s Handbook, the IBAI has classified the general insurers into four categories — Public Sector General Insurers, Large Private Sector General Insurers, Other Private Sector Insurers, and Standalone Health Insurers.

In the health insurance category too, New India Assurance came on top among the public insurers with a claim-settlement ratio of 95%. Aditya Birla Health, with a claim settlement ratio of 95%, was the best among standalone health insurers. Iffco Tokio and Bajaj Allianz were among the top large private sector general insurers with the best claims-to-settlement ratio of 90% or more, according to the IBAI handbook.

What has to be remembered in the case of health insurance is that it is combined data for group (corporate) and individual policies. Claim-rejection rates are historically lower in the case of corporate policies.

“Irdai does not give data for individual and group claims separately. Why not? Who is it protecting,” asked author-influencer Monika Halan. The real picture will emerge when separate claim-settlement data is available for individual health insurance policies. According to experts, incomplete or false disclosure, consciously or unconsciously, at the time of purchase of policies also contribute to rejection of claims.

In settling motor vehicle own-damage claims too, New India Assurance was the best public insurer with a claim-settlement ratio of 92%. Among large private sector insurers when it came to own-damage claim settlement, Royal Sundaram, Go Digit and SBI General came on top. Future Generali was the top among small insurers.

The insurance coverage, be it life or general, is low in India but the tax on insurance premiums, at 18%, is high. In India, insurance penetration is at 30%, and low in comparison to developed countries, like the US, where it is over 90%. Though there is no social security net and government medical infrastructure is rickety, the high 18% GST on insurance premiums defies logic.

Many users settle for a smaller cover due to high premiums, experts have told India Today Digital. Several reform measures are needed for the growth of the insurance industry and relief for people so that they can get better cover for themselves. Not just in terms of reduction of tax, there is a need for segregated data on claim-settlement ratios for individual and group policies for people to make an informed choice.

Source: India Today

Health insurers disallowed claims worth Rs 15,100 crore or 12.9 per cent of the total claims filed during fiscal 2023-24, according to data released by regulator Irdai. Of the total Rs 1.17 lakh crore claims under health insurance of general as well as standalone health insurers, only Rs 83,493.17 crore or 71.29 per cent were paid during the year ending March 2024.

Further, insurers repudiated claims amounting to Rs 10,937.18 crore (9.34 per cent) while outstanding claims totalled Rs 7,584.57 crore (6.48 per cent), said the annual report 2023-24 of Insurance Regulatory and Development Authority of India (Irdai).

There were about 3.26 crore health insurance claims during 2023-24 with insurers, of which 2.69 crore (82.46 per cent) claims were settled. Irdai said the average amount paid per claim was Rs 31,086. In terms of number of claims settled, 72 per cent of the claims were settled through TPAs and the balance 28 per cent of the claims were settled through in-house mechanism.

In terms of mode of settlement of claims, 66.16 per cent of total number of claims were settled through cashless mode and another 39 per cent through reimbursement mode. During the year 2023-24, general and health insurance companies collected Rs 1,07,681 crore as health, excluding personal accident and travel, insurance premium registering a growth of about 20.32 per cent over the previous year.

The general and health insurance companies had covered 57 crore lives under 2.68 crore health insurance policies, excluding policies issued under personal accident and travel insurance. At the end of March 2024, there were 25 general insurers and 8 standalone health insurers.

Public sector general insurers — New India, National and Oriental Insurance — are doing health insurance business in foreign countries. During the year 2023-24, they procured gross premium of Rs 154 crore from health, personal accident and travel insurance and covered 10.17 lakh lives.

The insurance industry covered a total of 165.05 crore lives under personal accident insurance during the last fiscal. It includes 90.10 crore lives covered under government flagship schemes — Pradhan Mantri Suraksha Bima Yojana (PMSBY), Pradhan Mantri Jan Dhan Yojana (PMJDY), and IRCTC travel insurance for e-ticket passengers.

Source: The Economic Times

Dussehra is a time of victory, celebration, and new beginnings. It marks the triumph of good over evil, making it the perfect occasion to start fresh and adopt positive habits. This Dussehra, why not make some healthy resolutions that will not only benefit you but also those around you?

Here are the top health and wellness resolutions you should consider to make this festive season more meaningful and secure your future.

-

Prioritize Your Mental Health

With the fast-paced lifestyle many of us lead, mental health often takes a back seat. This Dussehra, resolve to make mental wellness a priority. Whether it’s through meditation, mindfulness, or simply taking breaks when needed, find ways to relieve stress and maintain mental peace.

- Tip: Try starting your day with 10 minutes of meditation or breathing exercises to stay calm and focused.

-

Adopt a Balanced Diet

Festivals are known for indulgent food, but a balanced diet is key to long-term health. This Dussehra, aim to make smarter food choices, even while enjoying festive treats. Incorporate more fruits, vegetables, and whole grains into your meals to maintain energy and health.

- Tip: Follow the 80/20 rule: 80% of your food should be wholesome, while 20% can be indulgent festive favourites.

-

Commit to Regular Exercise

Physical fitness is essential for a long and healthy life. This Dussehra, resolve to stay active! Whether it’s yoga, walking, gym workouts, or even Garba, find activities that you enjoy and make them part of your routine. Regular exercise improves your physical and mental well-being.

- Tip: Start small! Commit to 30 minutes of physical activity each day—consistency is more important than intensity.

-

Secure Your Future with Health Insurance

Your health is your greatest asset, and securing it should be a top priority. This Dussehra, make a resolution to invest in comprehensive health insurance for you and your family. Insurance protects you against unexpected medical expenses and provides peace of mind in the event of a health emergency.

- Tip: Evaluate your insurance options and choose a plan that suits your specific needs. Consider policies that offer both preventive care and critical illness coverage.

-

Practice Digital Detox

In a world dominated by screens, it’s easy to get overwhelmed with information and distractions. Resolve to take time away from digital devices, especially social media, to refresh your mind and improve focus. Use this Dussehra to set healthy boundaries with technology.

- Tip: Set a specific time each day to unplug from all screens and spend time in nature or with loved ones.

-

Get Enough Sleep

Good sleep is crucial for overall health, yet many of us neglect it. This Dussehra, commit to getting 7-8 hours of restful sleep each night. Adequate sleep improves mood, memory, and immune function, helping you stay productive and happy.

- Tip: Create a sleep routine—avoid screens before bed, keep your room dark and cool, and go to sleep at the same time every night.

-

Stay Hydrated

It may seem simple, but staying hydrated is one of the easiest and most effective ways to maintain good health. Drinking enough water improves digestion, keeps your skin healthy, and helps you stay energetic throughout the day.

- Tip: Set reminders on your phone to drink water throughout the day, especially during the festive season when you’re more likely to get dehydrated.

-

Focus on Preventive Health Checkups

Prevention is better than cure! This Dussehra, make a resolution to schedule regular health checkups for early detection of any potential health issues. These checkups can save lives by catching conditions early when they’re easier to treat.

- Tip: Many health insurance plans now offer preventive health checkups as part of their benefits—take advantage of these features.

-

Be Kind to Yourself and Others

The festival season is about kindness, empathy, and positivity. This Dussehra, resolve to be kinder to yourself and to others. Practising kindness boosts emotional health and creates a ripple effect of positivity in your environment.

- Tip: Set daily reminders to appreciate yourself and your accomplishments, and make it a habit to offer words of encouragement to those around you.

This festive season, protect what matters most—your health and your future! Talk to our experts today to find the perfect health insurance plan tailored to your needs.

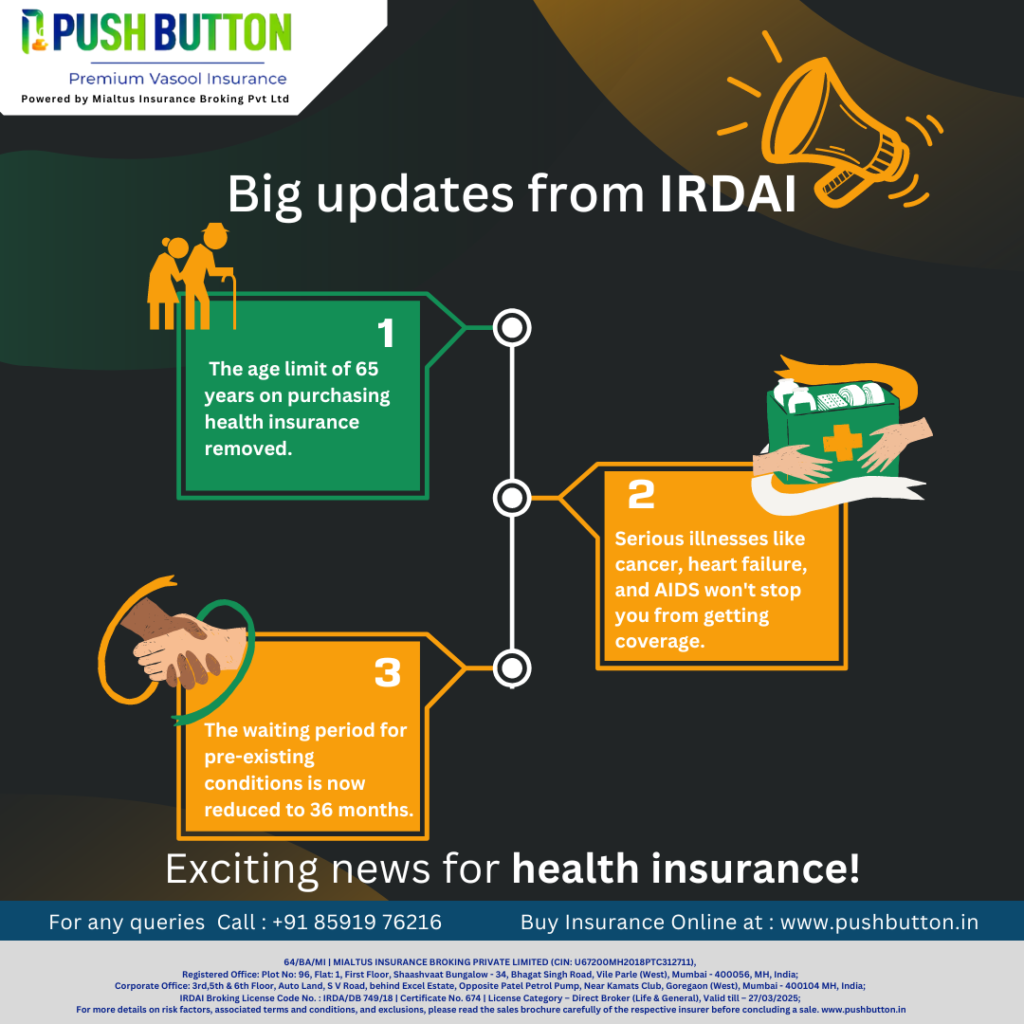

As of October 1, 2024, health insurance policies have become more favourable for customers.

Here are the key updates in health insurance regulations, making it easier to explain to potential buyers.

Key Updates in Health Insurance Policies:

-

Shorter Waiting Period for Pre-Existing Conditions

The waiting period for pre-existing conditions has been reduced from 48 months to 36 months. After this period, insurance companies cannot reject claims for pre-existing conditions, even if the policyholder didn’t disclose the condition earlier.

-

No Age Limit for Senior Citizens

Before, people over 65 couldn’t buy new health insurance. Now, there’s no age limit, so anyone—regardless of their age—can purchase a health policy.

-

Inclusive Health Coverage

Insurance companies must now offer health insurance to mental health patients, special needs children, transgenders, and people with HIV/AIDS. This makes health insurance more inclusive.

-

No Claim Denials After 5 Years

Insurance companies cannot deny claims after 5 years, even for reasons like non-disclosure or misrepresentation. However, if there’s proven fraud, the claim can still be contested in court.

-

Meaningful Discounts for No Claims

If no claims are made during the year, policyholders can choose between increasing the sum insured or getting a discount on their premium for the next year.

-

Refund Anytime

Policyholders can cancel their policy anytime and get a refund based on how long they used the policy. For example, if you pay Rs. 12,000 in premium and cancel after six months, you’ll get Rs. 6,000 back.

-

Higher Claim Settlement Chances

IRDAI has asked insurance companies to set up a committee called Claims Review Committee (CRC). This committee will review the claims, which are rejected by the insurer.

Further, claim requests can only be rejected after approval of this committee. Also, insurers will have to give reason for rejection along concerning the specific terms and conditions of the policy document.

-

Smoother Claim Settlement Process

Insurance companies and Third-Party Administrators (TPAs) must collect required documents directly from the hospital, so policyholders don’t have to submit them separately. Also, cashless claims should be processed within 1 hour, and final payments made within 3 hours of discharge.

At Mialtus Insurance Broking Pvt Ltd, we understand the challenges of maintaining good health and the importance of having comprehensive coverage. Contact us for the best health insurance policies and claim services. Our health insurance policies are designed to give you peace of mind, ensuring you and your family are protected during times of illness or medical emergencies. Call us on 8657528106 or visit our website to learn more about our customer-friendly health insurance plans.

In a landmark decision aimed at enhancing the well-being of the elderly, the Union government has approved a free health insurance cover of ₹5 lakh for all citizens aged 70 and above. This monumental move is part of the government’s flagship Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (AB PMJAY), ensuring that India’s senior citizens receive much-needed healthcare coverage at no cost.

This initiative is set to benefit 6 crore senior citizens across 4.5 crore families, providing crucial healthcare support to the elderly population, many of whom face rising medical expenses. The free health cover, worth ₹5 lakh per year, will be on a family basis and is aimed at ensuring that senior citizens have access to essential healthcare services without the financial burden.

A Lifeline for Senior Citizens

The approved health coverage will operate on a top-up basis. For families already covered under the Ayushman Bharat Scheme, the senior citizens above 70 years will receive an additional cover of ₹5 lakh, specifically reserved for their use. This coverage is exclusive to the individual above 70 and does not need to be shared with other family members who are younger.

This initiative is open to all senior citizens, irrespective of their socio-economic status, making it a truly inclusive scheme. Additionally, senior citizens who are already receiving benefits from other public health insurance schemes can choose to either continue with their current plan or opt into Ayushman Bharat PMJAY for this top-up benefit.

A Promise Fulfilled

This announcement comes as a fulfillment of Prime Minister Narendra Modi’s promise made during the run-up to the general elections. The PM had committed to improving the health infrastructure and making healthcare more accessible for all, particularly the vulnerable elderly population.

The decision underscores the government’s focus on providing healthcare security to senior citizens, who often face age-related health challenges and are more susceptible to chronic illnesses. By introducing this free health insurance cover, the government aims to alleviate financial stress on families and offer peace of mind to the elderly, knowing they can access medical care without worrying about high costs.

A Step Toward Universal Healthcare

The Ayushman Bharat PMJAY scheme has already been lauded as one of the world’s largest public health insurance initiatives. With this latest addition, the scheme continues to set benchmarks in providing healthcare access to the most vulnerable sections of society. The new health coverage for senior citizens further strengthens the government’s vision of “Health for All”, ensuring that no one is left behind, regardless of age or financial background.

What Does This Mean for You?

Families with senior citizens above the age of 70 can now rest assured that their loved ones are protected under the Ayushman Bharat scheme, with no additional cost. The scheme offers:

- Free health insurance coverage of ₹5 lakh per year, reserved exclusively for individuals above 70 years of age.

- Top-up cover for families already enrolled in the Ayushman Bharat scheme, ensuring more comprehensive healthcare for the elderly.

- Access to public and private healthcare facilities across the country, ensuring that senior citizens can receive timely and quality medical treatment.

Conclusion

The Union government’s decision to extend free health coverage to all senior citizens above 70 years is a significant step toward ensuring that India’s elderly population is well cared for. With this initiative, millions of families across the country will have the support they need to navigate healthcare challenges with ease, ensuring that senior citizens can live their golden years with dignity and security.

For more information on how to avail of this scheme or explore other health insurance options, feel free to reach out to us. Let’s work together to secure the health of your loved ones!

As the monsoon season arrives in India, it brings relief from the hot summer heat and opens the door to numerous health challenges. The increased humidity and water accumulation create an ideal breeding ground for various illnesses. We aim to shed light on the common illnesses that prevail during the monsoons in India and emphasize the importance of having insurance coverage to protect individuals and families from unexpected medical expenses.

Respiratory Infections:

- Cold and Flu: Discuss the prevalence of common colds and influenza during the monsoon season, highlighting their symptoms, causes, and preventive measures. Emphasize the significance of maintaining good personal hygiene and avoiding crowded areas.

- Allergies and Asthma: Explore how the increased moisture and mold growth during monsoons can trigger allergies and exacerbate asthma symptoms. Highlight the importance of proper medication management and maintaining clean indoor environments.

Waterborne Diseases:

- Dengue Fever: Shed light on dengue fever, a mosquito-borne viral infection that thrives during the monsoon season. Discuss its symptoms, prevention, and the importance of eliminating stagnant water to control mosquito breeding.

- Cholera and Typhoid: Explain the risk factors, symptoms, and preventive measures for waterborne diseases like cholera and typhoid fever. Highlight the importance of safe drinking water, proper hygiene, and vaccination.

Gastrointestinal Infections:

- Food Poisoning: Discuss how the monsoon season increases the risk of food contamination, leading to foodborne illnesses. Address the importance of consuming hygienic food, avoiding street food, and maintaining proper food handling practices.

- Diarrhea and Dysentery: Explore the causes and prevention of gastrointestinal infections during the monsoons, emphasizing the significance of clean water consumption and hygienic food preparation.

Insurance Coverage for Monsoon-Related Illnesses:

- Health Insurance: Highlight the role of health insurance in providing financial protection against medical expenses arising from monsoon-related illnesses. Discuss coverage for hospitalization, diagnostic tests, medications, and follow-up care.

- Critical Illness Insurance: Explain the benefits of critical illness insurance, which provides coverage for specific illnesses, including those prevalent during the monsoons. Discuss the importance of understanding policy terms, coverage limits, and waiting periods.

Preventive Measures:

- Personal Hygiene: Emphasize the importance of maintaining personal hygiene, including regular handwashing, avoiding contaminated water, and using mosquito repellents.

- Vaccinations: Highlight the significance of immunizations for diseases like dengue, typhoid, and influenza. Encourage individuals to consult their healthcare providers for the appropriate vaccinations.

Conclusion:

As the monsoon season arrives in India, it brings with it an increased risk of common illnesses. Individuals can safeguard their health by understanding the prevalent diseases and taking the necessary precautions. However, it is equally important to secure adequate insurance coverage to protect against unforeseen medical expenses. Comprehensive health insurance and critical illness insurance provide financial peace of mind, ensuring that individuals can access quality healthcare without the burden of excessive medical costs. Prioritizing both health and insurance coverage allows individuals and families to enjoy the monsoons while staying prepared for any health-related challenges that may arise.

If you need any insurance coverage or have any insurance-related inquiries, please don’t hesitate to contact us. Our experienced team is ready to assist you and provide the best insurance solutions tailored to your needs. Reach out to us today for a consultation to secure your financial future.

A vital component of life is health insurance, especially in India where the cost of healthcare is increasing quickly.

It is impossible to exaggerate the usefulness of health insurance or to undervalue it. Having health insurance can give people and families a vital safety net in a nation where medical emergencies and illnesses can strike suddenly.

Financial stability is the primary justification for why health insurance is crucial in India. Health insurance can greatly lessen the financial burden of medical bills like hospital stays, doctor visits, operations, and prescription prescriptions. The cost of healthcare can be extremely high. Without health insurance, the out-of-pocket costs can be exorbitant and put people and families into financial ruin.

Health insurance is essential in India because it gives people access to high-quality medical care. To preserve excellent health, regular checkups, doctor visits, and preventative treatment are crucial. Those who have health insurance can afford to see doctors frequently and receive prompt medical attention, which can stop minor health problems from developing into serious ones. A wider variety of physicians, medical facilities, and specialists are accessible with health insurance plans than with others. Access to more specialized and cutting-edge medical procedures may be made possible by these larger networks. For people with chronic illnesses or those who need specialist medical treatment, this is especially crucial.

Another thing that brings comfort is health insurance. It gives one a sense of security and lessens anxiety to know they can get access to high-quality healthcare when they need it. As vital as physical health is, this can also have a good effect on a person’s mental and emotional well-being.

Also, people may receive tax advantages from having health insurance. Individuals may deduct the cost of their own and their dependents’ health insurance premiums from their taxable income under ‘Section 80D’ of the Income Tax Act. Because of this, purchasing health insurance can be a lucrative investment, especially for individuals trying to minimize their tax obligations.

The community as a whole gains a number of advantages from health insurance in addition to the advantages it offers to individuals. Distributing the risk of pricey medical operations over a larger number of people helps down the cost of healthcare for everyone. This eases the financial load on taxpayers and lowers the cost of healthcare. Also, it encourages preventative treatment, which may assist in lowering the frequency of hospital stays and trips to the emergency room. In turn, this can ease the burden on the healthcare system and contribute to cost containment.

Despite the various advantages of health insurance, many Indians still lack coverage. This is mostly caused by people’s ignorance of the value of health insurance, as well as the high costs of such coverage. Yet, the development of technology has made purchasing health insurance more convenient and affordable than ever. People may now easily compare and purchase health insurance policies thanks to online portals and insurance aggregators, making it simpler to locate affordable coverage.

In conclusion, having health insurance is essential, especially in India. It benefits the community as a whole and offers financial security, access to high-quality healthcare, tax advantages, and benefits. To guarantee that everyone has access to high-quality healthcare when needed, without running the danger of financial ruin, health insurance must be prioritized. Because of technological improvements, purchasing health insurance is now easier and more reasonable than ever before, enabling customers to select a plan that meets their requirements and their budget.

Are you ready to prioritize your health and financial security with a health insurance policy?

Pushbutton offers a hassle-free and convenient way to buy health insurance online. Visit Pushbutton.in to explore our range of policies and choose the one that suits your needs and budget. Protect yourself and your loved ones today.